The Best Minimalist Stocking Stuffers for a Clutter-Free Christmas

Stockings are such a magical part of Christmas. But…Have you ever filled the stockings with random junk in order to cross another task off your holiday to-do list? Me too, but this year I am being more conscientious and carefully selecting clutter-free stocking stuffers.

Clutter-Free Stocking Stuffers that Aren’t a Waste of Money

As a practical minimalist, I cringe at the idea of traditional stocking stuffers.

For many of us (especially busy moms) stocking stuffers are a last minute Hail Mary in the hours leading up to Christmas.

This makes for bad decisions; mostly in the form of cheap junk that is neither wanted nor needed.

Where traditional stocking stuffers fall short is that by the time Christmas dinner on the table they have already been:

- Broken or forgotten

- Misplaced

- Strewn about the house making a mess

- Chalked up to a complete waste of money

The good news is that there is still time to avoid this all-too-common phenomenon!

I am here to help you by providing a tried and true list of items to include in a minimalist stocking stuffer.

Minimalist Stocking Stuffers Kids Will Love

This stocking stuffer gift guide is loosely based on the popular minimalist mantra of “The 7 Gifts Rule”.

For this clutter-free stocking version, I am following the categories, but you get to decide how many will fill their stocking 😉

When searching for stocking stuffer ideas, using these 7 categories can be helpful to make sure you don’t end up with a bunch of useless junk that the kids end up ignoring or throwing away.

- Something you want

- Something you need

- Something to wear

- Something to read

- Something to do

- Something just for me

- Something for the family

This post may contain affiliate links for your convenience. We only include brands we use and trust. See the full disclosure in the privacy policy.

Practical Stocking Stuffers (Something They’ll Use)

Reject the idea that stocking stuffers should be a bunch of cheap plastic toys and useless trinkets.

Instead, opt for stocking stuffers that kids can actually use and enjoy like these!

1. Blue Light Blocking Glasses

Protect your child’s eyes and enhance sleep with blue-light blocking glasses. Proven to reduce harmful blue light, these stylish glasses are perfect for the kid that needs to unwind after a long day at school or play.

2. Body Wash

No matter how much kids resist it, bath time is a must. Body wash is useful and practical gift that fits perfectly in a stocking.

3. Electric Toothbrush

Make brushing a little easier and more fun with an electric toothbrush. Not only do these brushes increase brushing time, but they also encourage good brushing habits.

4. Fun Band-Aids

A practical stocking stuffer that will definitely be used. Band-aids are a stocking-stuffer tradition in our house.

5. Flashlights or Book lamps

Tuck a book light into their stocking to encourage reading before bed. Perfect for camping, sleepovers, or reading under the covers.

6. Reusable Snack Bags

These colorful and eco-friendly bags are perfect for packing healthy snacks for school, practice or games. Kids will love the colors and you’ll love the savings over disposable bags.

7. Hydro Flask

With the majority of drinking fountains being closed for the time being, a reuseable water bottle is the gift that keeps on giving. Bonus – It fills up a lot of space in the stocking!

Something They’ll Wear

Stocking stuffers don’t have to be a waste of money. These stocking stuffers that kids can wear are fun and whimsical, but still clutter-free.

8. Beanies

Keep them warm with a stocking stuffer hat. Choose from a variety of colors and styles to fit your stocking size.

9. Fun Socks and Undies

Underwear and socks are classics when it comes to stocking fillers, but these color versions are so much cooler than boring white socks and underwear.

10. Jewelry

Bracelets, earrings and necklaces can be worn and loved for years. There are options at every price point that will fit perfectly in any stocking.

11. Sunglasses

Talk about practical and useful; sunglasses are sure to be loved and get plenty of use all year long.

12. Gloves

Keep their hands warm with a new pair of gloves for winter. A stocking stuffer favorite in our house!

Something They’ll Love

Just because a kid’s stocking stuffer is practical doesn’t mean it has to be boring. Consider giving them something they’ll love to make Christmas morning even more fun.

13. Wireless Earbuds

Your kiddo will love finding a pair of wireless earbuds in their stocking on Christmas morning and you will love to sit in peace and quiet while they play their music.

14. Pencil Pouch

Help them stay organized with a stocking stuffer pencil pouch. Available in many different colors and styles, kids will love the fun patterns and designs.

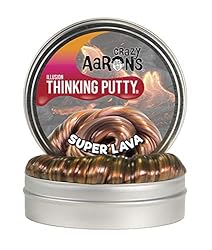

15. Thinking Putty

A stocking stuffer that entertains for hours. Stretch, bounce and squish this stocking stuffer putty over and over again.

16. Bath Bombs or Bubble Bath

Add a stocking stuffer that smells great to their stocking. These bath bombs are not only fun for kids, but also relaxing and good for the skin.

17. Nail Art Stickers

Give them something fun to put on their nails for a stocking stuffer. These stickers will have your kids looking glam and holiday-ready.

18. Water Bottle Stickers

These vinyl stickers are so popular right now. Grab this bulk pack and give your kiddos hundreds to choose from to customize their stainless water bottle.

19. Gift Cards

The perfect-sized gift for any stocking. Gift cards are a useful and fun stocking stuffer idea that everyone is happy to receive.

20. Tegu Blocks

Small blocks of wood with magnets inside. So simple and yet so fun! Kids will love these heirloom-quality blocks.

21. Fun Reusable Drinking Straws

A stocking stuffer that is not only fun, but also better for the environment. These reusable straws are perfect for your eco-conscious kiddo.

22. Paint Stix

If you’ve got a big stocking to fill, these quick dry paints won’t disappoint. These paint sticks are mess-free and fun!

22. Smencils

These scented pencils are made from recycled paper and are a fun way to get kids excited about doing their homework.

23. Kids Cooking Utensils

Your little baker or sous chef will love getting their own cooking utensils. The perfect shape to slip into a stocking!

Edible Stocking Stuffers (Something They’ll Eat)

These stocking stuffers are edible which means they won’t be left around the house for you to pick up. These clutter-free stocking stuffer snacks and treats will be the perfect Christmas morning surprise.

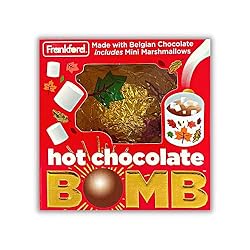

24. Hot Chocolate Bomb

25. Peppermint Hot Chocolate Stir Sticks

Kids (and adults) will have so much fun giving their hot chocolate a sweet candy-cane flavor with these peppermint stir sticks.

26. Holiday Flavored Salt Water Taffy

Chewy, sweet, and delicious, these holiday-flavored taffies are perfect for tossing into a stocking for an extra treat!

27. Fun International Candy and Snacks (think Cost Plus World Market)

Delicious and fun, these candies and snacks from countries all over the world are a great way to learn about other countries and geography.

28. A Bottle of Frostie Soda

Your kids will think that Santa brought this special soda straight from the North Pole just for them!

30. Classic Chocolate Orange

Oranges are said to represent gold when placed in stockings. Your child will be super excited to receive this chocolate version that they can enjoy, and you will enjoy that it disappears.

There you have it mama! Over 30 unique and clutter-free stocking stuffers for your minimalist Christmas.

Kids stocking stuffer ideas need not be boring or a waste of money! Consider giving them something they’ll love to make Christmas morning even more fun with these stocking stuffers for kids that they will actually want, use, wear and love.

Minimalist Stocking Stuffers Your Kids will Love!!!

These are all great ideas! My mom used to (and still does actually) put puzzle books in our stockings. We loved the games and challenges and they’re so inexpensive.

Puzzle books are a great consumable Christmas gift idea! Love it!

This is genius! I already do the rule of four for gifts and now… I’ll do it for stockings too!

Hi Bailey – so glad you found my tips for clutter-free stocking stuffers helpful. Finding fun and practical gifts for kids is not always easy. It’s a balance between keeping the gifts fun and pleasing my minimalist mindset. I think these stocking stuffers are the perfect solution to a clutter free Christmas!

I’m getting better about only buying thoughtful gifts the recipient can actually use, but I admit I often resort to junk to fit in the stockings. But not this year! Armed with your list I won’t be wasting any more money on junk! Thanks!

Yay Tracy! I think we have all been guilty of putting a bunch of junk in the stockings – myself included! That is why I wanted to share these ideas with other moms who are trying to avoid wasting money on stocking stuffers that are just going to end up in the garbage.

Such great ideas that seem practical and ones they’d enjoy too!!

Hi April –

Thank you! That was my goal – to share a list of no-junk stocking stuffers that kids would actually like!

Great list of ideas! We live right on lake ontario, so we have some cold, blustery winters. That, along with the very dry heat to keep us warm, I always add good chap stick and hand lotion to everyone’s stockings!

These are great ideas, I’ve looked at tons of lists like these and you made some really unique suggestions!