25 Open-Ended Toys that Encourage Creativity

Open-ended toys allow children to use their imaginations and be creative while they play. Today I am sharing some of our family’s favorite open-ended toys that also come in their own storage container!

What are Open-Ended Toys?

Open-ended toys foster creativity and imagination because they can be used in many different ways.

Blocks, Play-Doh, and Legos are all considered open-ended because it is the creativity of the child that determines how the toy will be used.

An example would be the same block being used as a car, a tree, and as part of a building.

The Benefits of Open-Ended Play

Because open-ended toys do not dictate the way that young children play there are many benefits including:

- Learning to make choices

- How to express their creativity

- Supporting their independence

Open ended toys also help children to develop spatial awareness, fine motor skills and provide an opportunity for them to express themselves.

Today I am sharing simple toys that will be used and loved for years to come.

The 25 Best Open-Ended Toys for Kids

This post may contain affiliate links for your convenience. We only include brands we use and trust. See the full disclosure in the privacy policy.

When you look for open-ended toys try to think back to when you were a kid…

What were your favorite toys that allowed you to use your imagination to build, create and pretend?

Most likely your list is going to include things like:

- Blocks

- Play-Doh

- Legos

- Clay

- Sheets, Towels, Blankets and Scarves

- Magnetic Building Toys

Guess what? Those are all open-ended toys and the reason why you loved them as a child is because they were so versatile.

The same will be true for your own child, so think of these toys as an investment in their skills when it comes to creativity, imagination, innovation and independent play.

Here are a few of our family’s favorites:

The Best Open Ended Toys

Open-ended toys encourage unlimited imaginative play for kids. Here is a list of some of the best open-ended toys for kids that will lead to hours of engagement and play.

Rainbow Pebbles

Bright colors and a variety of shapes and textures make these rainbow pebbles fascinating for kids. Watch as they create creatures, stack, sort and design with these versatile stones.

Natural Wooden Balancing Blocks

A delightful stacking toy that is perfect to play with on their own or to add to a traditional wooden block set. Children will use these for hours of pretend play as they use them as rocks, gems, people and more!

Melissa & Doug Wooden Blocks

The set is made of 60 smooth finished, solid-wood. The shapes are specifically designed to encourage imaginative play and to develop skills like shape identification, fractions and sorting.

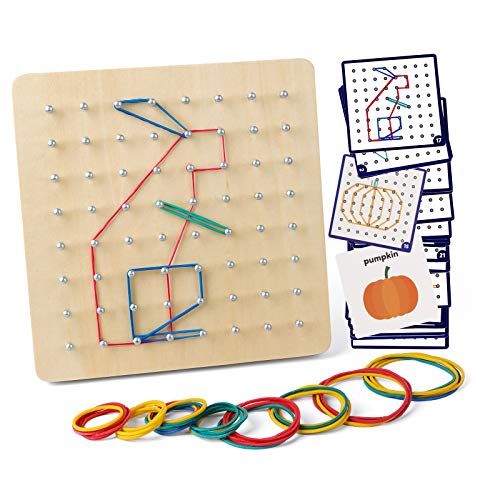

Wooden Geoboard

Kids will love making patterns, shapes and images with this wooden geoboard. The creative possibilities are endless as children learn how to use their imaginations to create their own images.

Wooden Wobble Balance Board

Can be used by children of all ages ( and even adults) The Wooden Balance Board is whatever you imagine it to be - a swing, a bridge, a shop, a cabin, a stepping stone, a racetrack, a lounge chair, fitness equipment, a puppet, a small football goal, a teeter popper or a tunnel.

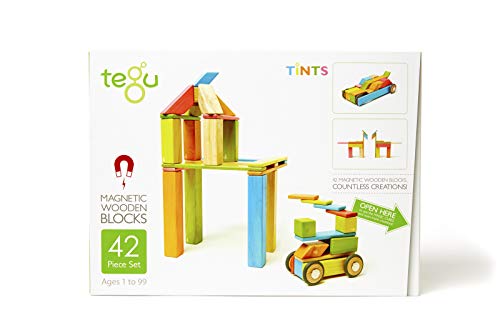

Tegu Magnetic Wooden Block Set

Tegu wooden blocks are an heirloom-quality toy that will be adored for ages. Perfectly designed for open-ended and unscripted play. This set includes shapes that will develop skills like balance, scale, problem solving and story telling all with a natural and non-toxic finish.

LEGO Classic Creative Brick Box

- With over 480 pieces, kids will spend hours engaged in pretend play with this building kit. This open-ended toy allows kids to create anything they can imagine.

- The container can be used as toy storage too!

Eco-Friendly Magic Modeling Clay

This box is full of endless creativity and possibilities....and modeling clay! Non-toxic and eco-friendly this air-drying modeling clay will allow your child to unleash their ideas and artistic side for hours.

Play Silks

Made from 100% silk, these are a great sensory-friendly toy that can be used for dance, dress up, and more.

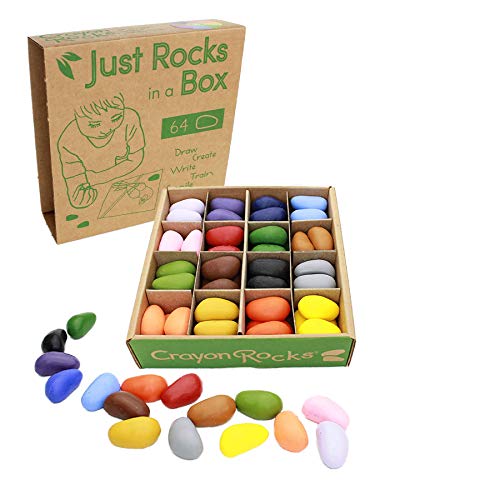

Just Rocks in a Box Crayon Set

Kids will be amazed by the rock shaped crayons. Perfect ergonomic design recommended by occupational therapists along with a fun design that allows them to be so much more than just your regular ol' crayon.

KidKraft Wooden Farm to Table Play Kitchen

Watch as your kids use this play kitchen in a variety of ways. From cooking breakfast to running a restaurant, the possibilities are endless.

SmartMax Build XXL STEM Magnetic Discovery Set

Over 70 pieces and a sturdy storage case makes this a popular choice among kids and adults. Consisting of oversized magnetic rods and spheres, kids will love the tactile process of building extraordinary structures.

Unfinished Peg Dolls

High quality and non-toxic, these peg dolls allow a child to create a number of imaginary play scenarios. Leave them unfinished or paint them for a fun craft.

Kinetic Sand

A wonderful toy for sensory development! Kinectic sand is squeezable and moldable and feels just like real wet sand! Store in the case to ensure that it lasts for years!

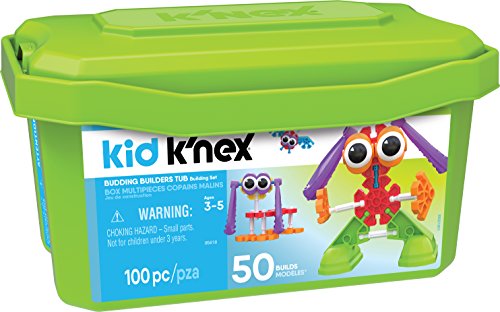

Kid K’NEX – Budding Builders Set

This awesome open-ended STEAM (science, technology, engineering, arts & math) toys will tap into your child's imagination, curiosity and creativity. This building set comes in a plastic tub for convenient storage of built models and loose parts. Responsibly made in America at a landfill-free, zero-waste green manufacturing facility.

LINCOLN LOGS-Centennial Edition Tin

This classic creative construction toy has been a hit with kids for over 100 years. Made of real, high-quality maple kids will enjoy using their imaginations to create cabins, barns and towns with these easy to use wooden logs.

Magformers Basic Rainbow Tub Set

Magformers are the original magnetic building tiles for kids. Created with the idea that open-ended creative play is essential for a child's development these blocks are well made and perfectly designed for endless imaginative play.

Taksa Resources Creative Open-Ended Construction Toys

These nature-themed, Montessori inspired stacking and building blocks have a uniquely modern design that your kids will love. Every build is full of discovery and experimentation as kids put these non-traditional shapes together in new and creative ways.

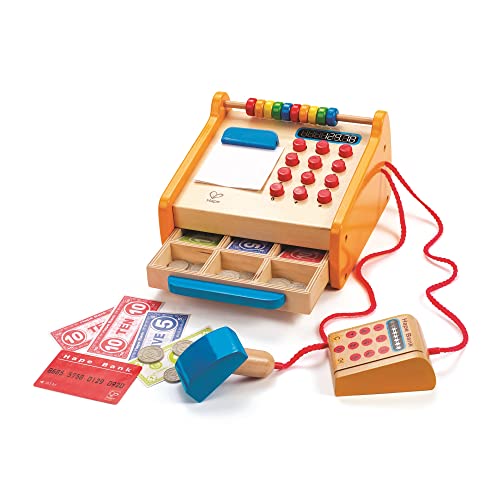

Hape Checkout Register

A toy that truly has a million uses! From running their own bakery to selling toys, children will love this toy cash register. A great tool for developing social skills and promoting language.

Creative Nesting Rainbow Blocks

- These colorful, triangular building blocks offer different possibilities than conventional building blocks or planks. They inspire creativity: triangular building blocks can be used as tunnels, little houses, hills, rocking chairs or beds for little dolls... let your imagination lead!

- Children (of all ages!) love to nest or stack the colorful, unique blocks, or use them as an open-ended toy in pretend play.

ALEX Toys ZOOB Moving Modeling System

Over 100 moving, open-ended pieces for kids to enjoy as they construct, engineer, explorer and experiment.

Nesting Wooden Rainbow Stacking Toy

This educational toy stimulates creativity and imagination through open ended play: includes FREE downloadable activity sheet to challenge your kids to recreate different stacking formations. Crafted from natural, high-quality wood and toxic-free paint that will NOT chip or flake.

PicassoTiles Magnetic Drawing Board

Full of open-end possibilities to facilitate and cultivate children's creative and powerful mind. Children can acquire strong sense of geometrical shape, architectural design, structural engineering.. STEM Science, Technology, Engineering, Art, and Math, all-in-one enabling the kids to learn by intuitive playing and bring out the best of all to be artistically creative while technically, architecturally, and intelligently advanced at the same time. MADE OF CHILD SAFE, NON-TOXIC, BPA-FREE and lead-free, tested in CPC accredited lab.

Oversized Hollow Wooden Block Set

Big blocks for big ideas! Little architects will love building ramps and cities with these oversized building blocks for toddlers. Children can construct buildings, roadways, multi-level homes, and more

Calm Mind Play Set

Perfect for sensory play, this set will help to strengthen fine and gross motor skills that nurture child brain development. Spark creativity, imagination and language development through pretend play. From being a superhero to mixing it in a pot, this is a fun way to introduce creative play.

Looking for more gift ideas? Check out the list below.

How to Encourage Pretend Play

As a new mom, I had one question when it came to choosing toys for my children:

Why do all the best toys have to be so messy?

- Legos

- Blocks

- Play-doh

- Craft Supplies

The same toys that allow children to develop important skills often have tons of pieces that are:

- Messy

- Easy to lose

- Difficult to keep neat and tidy

When our family started exploring minimalism, I decided to search for gender-neutral toys that came with their own storage solution.

This has allowed me to perpetuate my love of all things organized while the children are still allowed to play, build and explore.

We have found that when the toy comes with it’s own storage container, the kids naturally put everything away when they are done playing.

It keeps our home neat and tidy and keeps me from going all “Mommy Dearest” about Lego pieces being everywhere 😉

If you love to keep an organized home – or would like to start being clutter-free with kids you are going to love these clutter-free toys.

Because the truth is that kids need these messy toys to learn how to create, pretend and use their imaginations.

There you have it mama! Tons of clutter-free gift ideas that support open-ended play.

The Best Pretend Play Toys

A heads up- a large percentage of these gift suggestions are listed as unavailable or the link goes to a page with no product. Maybe time to update the post?

Thanks Sharon. It was just updated, but during the holidays many of the items sell out. I try my best to check in every few days. Thanks!